ASSET IMPAIRMENT TEST

According to applicable accounting standards (whether Polish or international), the value of assets included in the company's balance sheet should be regularly assessed and tested. It is the obligation of the management of the entity, that is, the company's board of directors, a partner (in the case of a general partnership or civil partnership), a general partner (in the case of a limited partnership or limited joint-stock partnership) or an individual (in the case of a sole proprietorship).

In a situation, where there are indications of an asset impairment, a write-off should be recorded in the books.

The indications for impairment can be twofold:

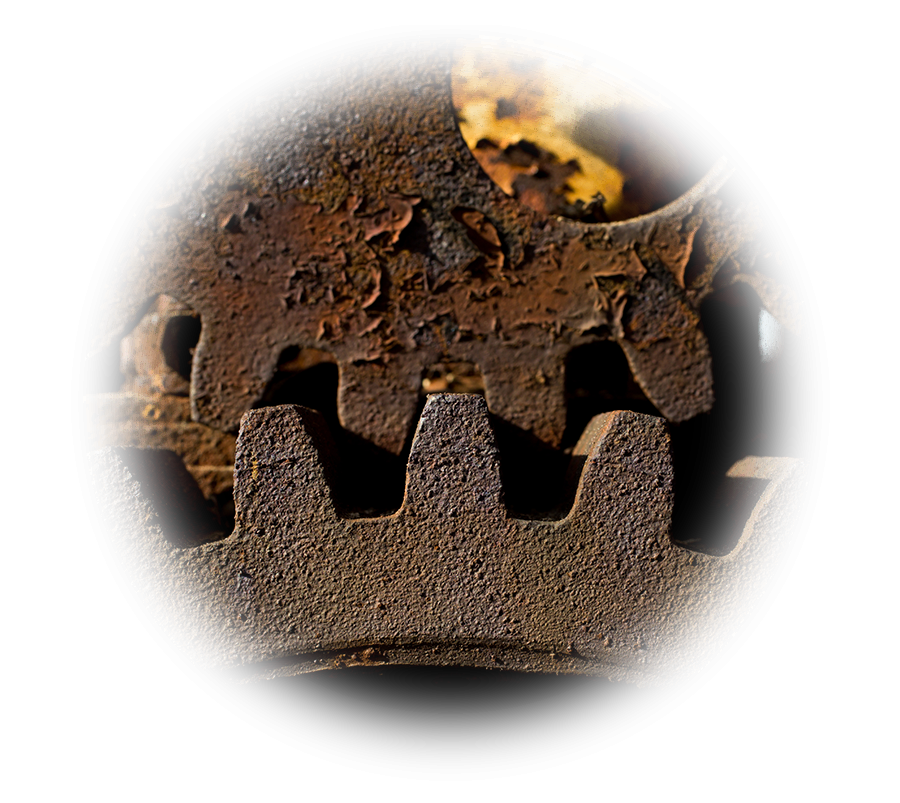

- internal, including: high probability of occurrence or actual occurrence of significant negative changes in the manner and scope of use of the asset, deterioration of its economic efficiency, loss of usefulness or physical damage;

- external, including (but not limited to): high probability of occurrence or actual occurrence of significant market, legal, economic or technological changes that would affect the value of the asset.

The impairment test should be performed on the smallest separable group of assets (known as a cash generating unit, or CGU) that collectively generate economic benefits.

When the indication(s) for an asset write-offis/are confirmed, the question arises as to its amount. For this purpose, an asset impairment test should be carried out, according to the procedure described in detail in relevant accounting standards.

For companies reporting under Polish Accounting Standards, the test should be performed based on the procedures described in National Accounting Standard No. 4 "Impairment of Assets" (KSR 4). Companies reporting under IFRS should perform the test based on the procedures of International Accounting Standard 36 "Impairment of Assets" (IAS 36). For companies reporting under U.S. standards, these would be procedures described in U.S. Generally Accepted Accounting Principles (U.S. GAAP), such as ASC 350-20 (Accounting Standards Codification), or ASC 360-10.

For example, performing an impairment test of an asset in accordance with the requirements of International Accounting Standards (IAS 36) involves comparing its carrying amount with the so-called recoverable amount. The excess, if any, of the carrying amount over the recoverable amount is the value of the impairment loss to be recognized against the profit for the financial period.

Recoverable amount is the value that a company can realize in relation to an asset. There are two ways to realize the economic benefits of an asset: disposal or further use. The requirements of IAS 36 permit alternative reference to these two approaches when determining the recoverable amount. In case of asset disposal, value of the asset can be calculated by determining its fair value less costs to sell. On the other hand, value in use is derived from the future cash flows that an entity will realize from the use of the asset, less the expenses incurred to realize those flows. The recoverable amount is the higher of the two amounts indicated (fair value less costs to sell and value in use).

Out team has extensive experience in impairment testing of fixed assets and goodwill. This includes both domestic (KSR) and international (IAS or US GAAP) standards.